A recent deep-dive into the history of the dye pack got me wondering about long-term trends in bank robbery. So much brainpower has gone into devising gadgets and strategies that allegedly help financial institutions minimize the risk of getting hit. Are those security investments working?

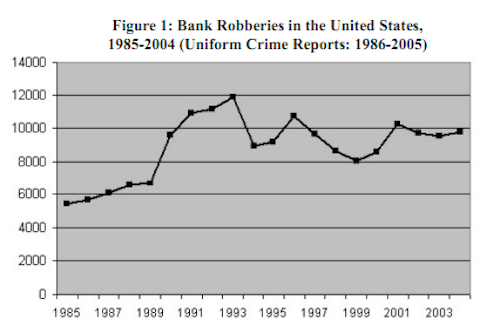

That’s a tougher question to answer than I had anticipated, as the basic stats on the crime don’t seem too favorable. As you can see above, the sheer number of robberies has increased since the mid-1980s, more than keeping pace with population growth. On top of that, robbers are enjoying ever greater odds of escaping arrest (PDF):

Although the clearance rate for bank robbery is among the highest for all crimes, the rate has declined. In the United States, bank robbery clearances have dropped from 80 percent in 1976 to 58 percent in 2001; clearances vary by region, from as low as 34 percent to as high as 80 percent.

That isn’t to say that all those crafty anti-robbery techniques have been for naught. A big factor in the crime’s growth seems to be the proliferation of small suburban branches, where police response time is much greater than in central areas. Without innovations such as single-door entryways, dye packs, and greeters, there’s no telling how high the rate might be today.

More important, there’s some really interesting cost-benefit analysis going on here. The average take from each bank robbery is just around $4,000, and about 60 percent of all stolen money is eventually recovered. A quick back-of-the-envelope calculation thus concludes that American banks lose just around $16 million to robber each year—peanuts compared to liabilities they might face if a botched robbery led to customers’ deaths. As a result, there is little incentive for banks to do much to change the status quo—the current situation, in which bank robbery is nothing more than a well-managed risk, suits them just fine.

scottstev // Aug 29, 2011 at 11:38 pm

The Washington Post (I believe) had a great article about bank robbery. Basically the gist is that the odds of getting away with a single bank robbery is pretty good. However, almost all bank robbers get caught in their career; unable to walk away they keep robbing until caught. So no only is the take small, the malefactors will be punished eventually, so why try to stop all robberies with high-risk tactics.

Of looking at the Somali Pirate problem, the increased frequency and risk during each event has lead to a much more robust response for good or ill.

Brendan I. Koerner // Aug 30, 2011 at 8:44 am

@scottstev: I’ll have to look that piece up–I’m very interested in how banks have run the cost/benefit analysis on robberies.

The Canadian article I link to in the post has a great tidbit about how greeters are such a key element to current bank security practice. The theory goes that most potential robbers are far from master criminals–lots of drug abusers and other desperate souls who don’t put much planning into their crimes. When they see a greeter, they supposedly realize that the crime will be hard to pull off, since there is already a good witness who can ID their faces. And so they turn around and abandon their plans.

scottstev // Aug 30, 2011 at 3:26 pm

My Google-Fu is improving.

http://www.washingtonpost.com/wp-dyn/articles/A6813-2004Aug16.html

Brendan I. Koerner // Aug 30, 2011 at 6:00 pm

@scottstev: Thanks for the link. Good story, but strange how it doesn’t mention the fact that the clearance rate has plummeted over the past few decades. As noted above, I think a lot of it has to do with the fact that suburban branches make for easier targets. And maybe (and this is just a guess) the fact that drug addicts commit so many of those robberies has played a role–a lot of ’em probably end up going to prison for other crimes.